“Paying for college can be difficult, particularly for parents who want the best for their kids. The Parent PLUS Loan is an important instrument that helps families afford higher education by opening opportunities.

Comprehending Parent PLUS Loans

A federal loan program called the Parent PLUS Loan is intended to assist parents or legal guardians in paying for their dependent undergraduate students’ education. With the help of this loan, which the US Department of Education manages, parents can fill the difference between their kids’ financial aid and the cost of attendance. Here are some important things to think about:

Advantages of Parent PLUS Loan

**Flexible Loan Limits:** Students attending more expensive universities may find the Parent PLUS Loan a good option because it has no fixed borrowing cap.

**set Interest Rate:** The Parent PLUS Loan has a set interest rate. Which offers predictability and stability in contrast to private loans, which may have changing interest rates.

– **Deferral Options:** Parents’ burden throughout their children’s college years can be lessened by delaying Parent PLUS Loan repayment as long as the student is enrolled at least half-time.

Qualifications and Application Procedure

Parents who want to qualify for a Parent PLUS Loan must fulfil specific requirements.

– Have legal custody of a dependent undergraduate student or be a parent by birth, adoption, or other arrangement.

– Do not own a credit history that is negatively impacted, such as bankruptcy, foreclosure, or default during the previous five years.

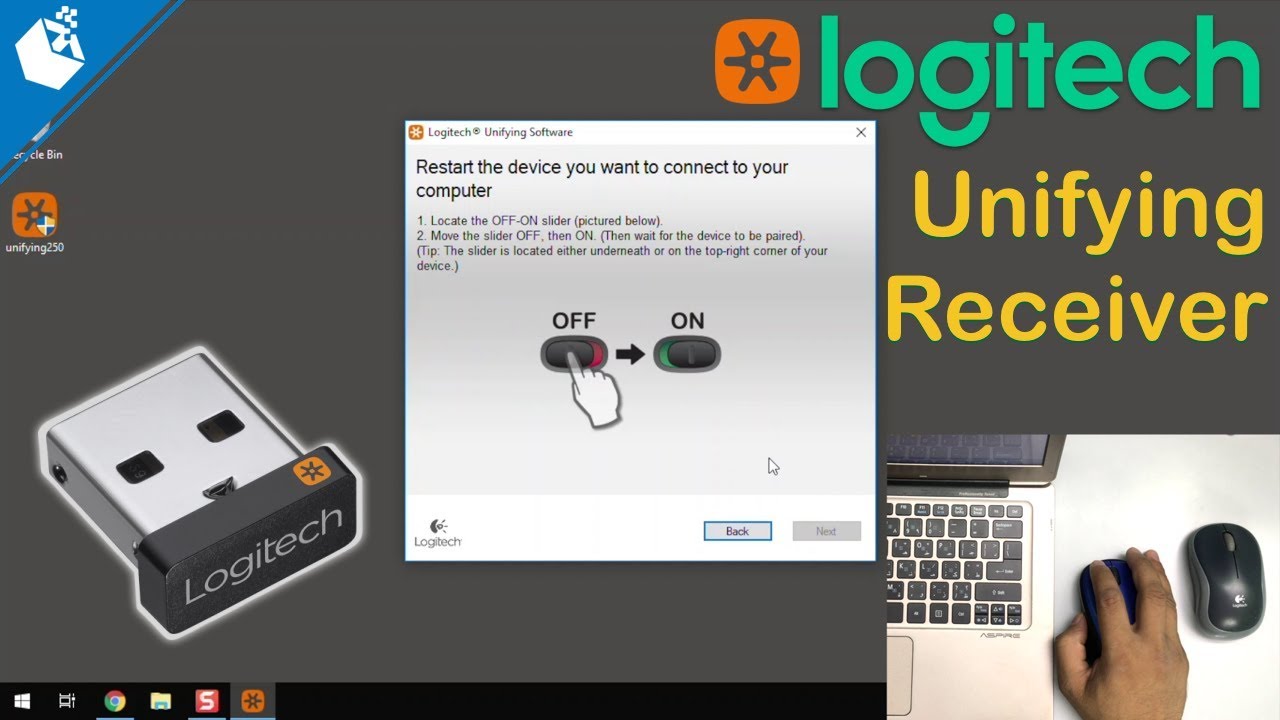

Parents who meet these requirements can apply online via the Federal Student Aid website. Where they must complete the required paperwork and check their credit.

Examining Non-Patent PLUS Loan Options

Even though there are many benefits to the Parent PLUS Loan. It’s important to consider your options to make the best financial decision for your family. Think about these options:

1. Loans for private students

The Parent PLUS Loan may be replaced with private student loans, which several banks and credit unions provide. Important characteristics consist of:

– **Potentially Lower Interest Rates:** Parents may obtain lower interest rates with private loans, contingent on their credit history and financial situation.

– **Loan Co-Signers:** The loan terms and the interest rate could be improved if the student has a trustworthy co-signer.

– **Adaptability in Repayment:** Lenders of private student loans frequently provide a range of repayment options to suit varied budgetary constraints and provide extra flexibility.

> Callout: To select the finest private lender for your situation, compare interest rates, repayment terms, and benefits provided by various lenders.

2. Home Equity Credit Lines or Loans

A home equity line of credit (HELOC) or loan can be a different way for homeowners to pay for their child’s college education. Among the benefits are:

– **Potentially Lower Interest Rates:** Compared to some alternative lending options, home equity loans and HELOCs may have lower interest rates.

– **Potential Tax Deductions:** Home equity loans and HELOC interest payments may qualify for a tax deduction, offering possible financial advantages.

Callout: Nevertheless, evaluating the dangers involved with taking out a loan against one’s house is critical. Considering the possible effects on one’s future financial security.

3. Scholarships and Loans Specifically for College

Many educational establishments offer loans and scholarships specifically tailored to their students’ needs. These efforts may provide unique benefits such as:

– **Lower Interest Rates:** College-specific loans may be more affordable than standard loans.

– **Specialized Scholarships:** To lessen the financial burden, universities frequently provide unique scholarships to deserving applicants.

> Callout: Consider these choices carefully and early in the college application to take advantage of substantial opportunities and cost savings.

In summary

Overcoming the challenges of paying for your child’s college education requires serious thought and comparison shopping. Offering flexibility, set interest rates, and support for families, the Parent PLUS Loan is a useful tool. Evaluating alternatives, such as home equity options, private student loans, and loans and scholarships tailored to particular colleges, is crucial. You may make an informed decision that opens doors and encourages your child to follow their academic goals by assessing the benefits and alternatives.”

Recall that you may guarantee a better future for your child by starting early with financial preparation and consulting financial aid specialists. This will help you negotiate the complex world of college funding.