“Are you in need of financial flexibility right now? Are you trying to find something that’s accessible and convenient? Look no further than loans for instalments. This post will examine the benefits of installment loans and show you how they can give you more financial flexibility. We’ll explore all the information required to create an informed choice, from comprehending the fundamentals to identifying their advantages.”

Comprehending Installment Loans

Installment loans are a particular loan arrangement in which borrowers are paid a set amount of money by their lender. Installment loans allow borrowers to repay the money over a certain length of time in regular payments, as opposed to payday loans or other short-term choices.

How Function Installment Loans?

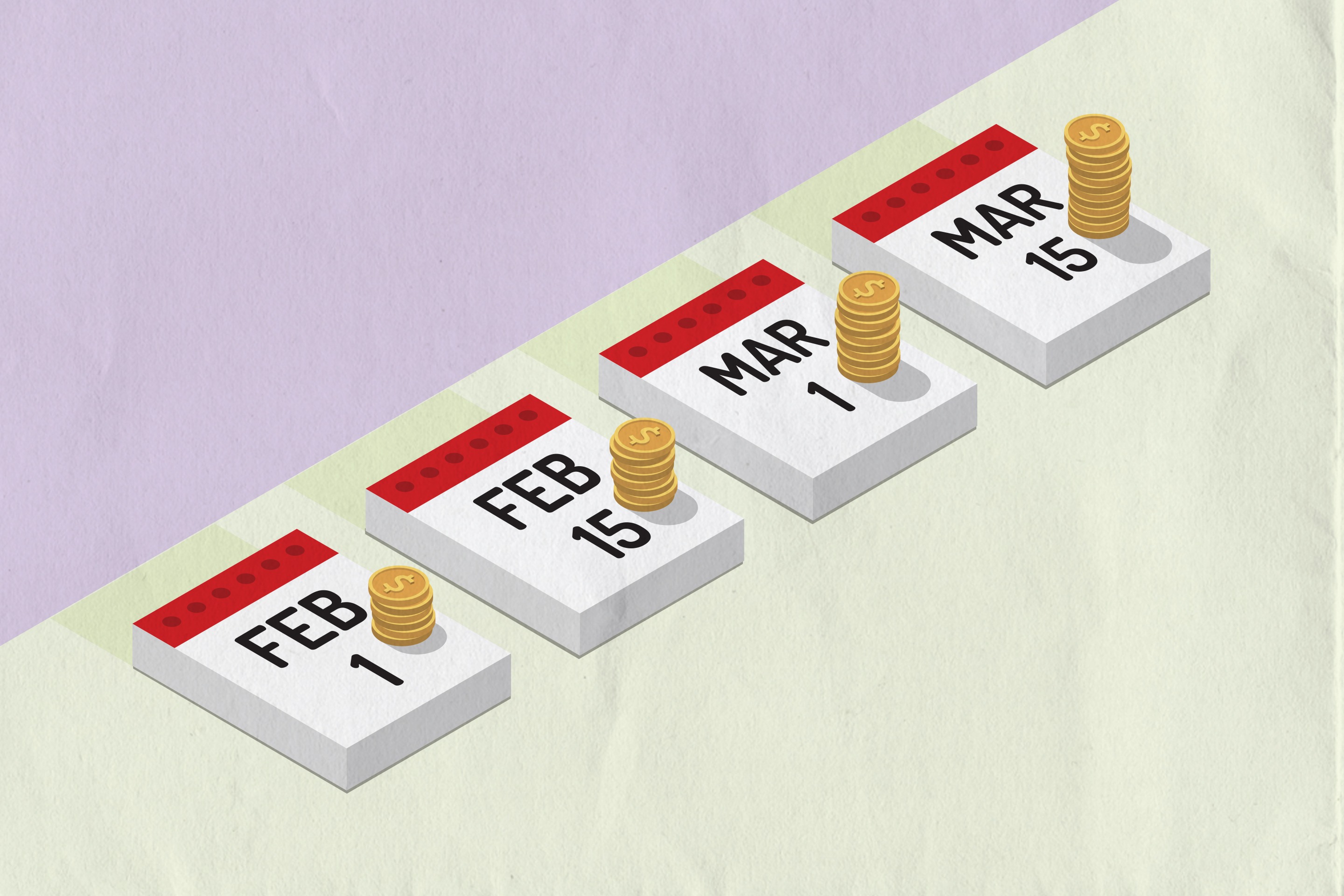

The basic idea behind installment loans is simple. The lender will give you a lump sum when you get an installment loan. The loan is repaid over a predetermined time, usually in equal monthly installments. The principal (loan amount) and interest are paid back in instalments, providing a well-organized and feasible repayment schedule.

The Advantages of Loan Installments

Due to its advantages, installation loans are desirable for many people. Among the principal benefits are:

Convenience and Flexibility

Instalment loans offer unlimited flexibility, which lets borrowers customize their payback plans to suit their budgets. Installment loans can meet your demands whether you require a longer period or prefer shorter repayment terms. Furthermore, making fixed payments monthly is convenient and promotes sound financial planning. It also provides peace of mind.

Reachable by All

Installment loans are available to more people than typical bank loans, which can include harsh credit checks and copious amounts of documentation. More people will obtain the necessary financial support because of this inclusion.

Clear and Reasonable

When you select an installment loan, you can anticipate openness at every stage of the procedure. To ensure no unpleasant surprises, the lender will explain the loan amount, interest rate, and repayment terms upfront. Furthermore, many consumers find installment loans reasonable because they frequently have competitive interest rates.

Possibility of Credit Building

Installment loans might be a great first step if you have a short credit history or want to raise your credit score. You can gradually improve your creditworthiness by exhibiting responsible financial conduct by paying your bills on time and repaying the loan.

How to Make the Most of Installment Loans

Even though installment loans are very flexible, you must use them carefully. To help you get the most out of this financial instrument, consider the following advice:

Evaluate Your Requirements

Consider your financial needs carefully before applying for an installment loan. Ascertain the precise amount you need and whether an installment loan is the best choice for your circumstances. Evaluate your ability to comfortably repay the debt as well.

Examine Lenders

Evaluating and investigating various lenders is critical to identify the most reliable and trustworthy choices. Seek lenders with favourable customer feedback, flexible payback arrangements, and fair interest rates. A seamless borrowing experience can be ensured by carrying out extensive research.

Establish a Budget

Ensure your spending plan allows for the payments of your installment loans to prevent any financial hardship. Calculate how much you can contribute to repayments by looking at your monthly income and spending. You can make on-time payments and avoid further fees or penalties by adhering to a budget.

Remain on Course

It’s critical to maintain timely repayment of your installment loan once approved. To ensure you always remember a deadline, set reminders or set up automatic payments. Being on top of your repayments on time keeps your credit history intact and helps you avoid late fees.

> “A strong tool for gaining financial flexibility is an installment loan. Through comprehension of their operation, optimization of their advantages, and prudent utilization, one may fully leverage the potential of instalment loans and establish a more favourable financial trajectory.”